If you’re like 36% of Americans who can\’t cover a $400 emergency (Federal Reserve 2024), you know just how shaky financial cushions can be. But here’s the kicker: the old-fashioned “3–6 months” rule for an emergency fund? It’s outdated. Today’s economy demands a smarter, personalized approach. In this post, we’re cutting through the noise to show you exactly how much financial cushion you really need in 2025—tailored to your job stability, family setup, and unexpected risks. No fluff, no guesswork—just clear, actionable guidance so you can finally feel secure when life throws curveballs. Let’s get into it.

Why Most People Get the Emergency Fund Size Wrong

Let’s be honest: the old advice about emergency funds — keep 3 to 6 months of expenses saved — isn’t as clear-cut as it once was. This rule traces back to the 1990s, a time when job stability was the norm, healthcare costs were more predictable, and inflation wasn’t the monster it is today. Back then, a steady 9-to-5 job was guaranteed for many, and gig work or freelancers weren’t a common career path.

Fast forward to 2025, and the picture looks very different. Inflation has driven up everyday costs, healthcare bills surprise even the most careful planners, and the rise of the gig economy means many people face irregular income streams. Add in unpredictable layoffs and rising housing expenses, and suddenly, that neat 3-6 month rule feels outdated.

Another common mistake? Confusing your emergency fund with sinking funds or investments. An emergency fund is your financial cushion—money set aside exclusively for unexpected expenses like sudden job loss or urgent home repairs. It’s not for planned purchases (that’s a sinking fund) or investing (which can be too risky and illiquid in a crisis). Mixing these up can leave you underprepared when real emergencies hit.

Action step: If you’re using the classic 3–6 month rule as a one-size-fits-all benchmark, it’s time to rethink, especially if your income or expenses don’t fit that old mold. Your emergency fund should be a customized safety net, not just a number from decades ago.

The 4 Key Factors That Determine Your True Emergency Fund Size

Not everyone needs the same emergency fund. To figure out your true financial cushion, focus on these four key factors:

1. Job Stability & Income Predictability

If you have a steady 9–5 job with dependable paychecks, your risk is lower. But if you’re self-employed, freelance, or work in a shaky industry, your income may be unpredictable. That means you’ll want a bigger emergency fund to cover longer dry spells.

2. Fixed vs Variable Monthly Expenses

Look at your essential monthly costs—rent, utilities, groceries, insurance. Are these mostly fixed or do they fluctuate? If you have variable expenses, it’s safer to plan on the higher side so you’re covered when bills spike.

3. Family Structure & Dependents

Supporting kids, elderly parents, or others adds financial responsibility. More dependents usually mean a bigger emergency fund. Single parents or sole breadwinners especially need a larger cushion since there’s no backup income.

4. Health, Insurance Gaps & Industry Risk

Do you have a high-deductible health plan or chronic medical conditions? Unexpected medical bills can drain your fund fast. Also, consider industry risks—some sectors are more vulnerable to layoffs or slowdowns, so plan accordingly.

By weighing these factors, you’ll arrive at a balanced emergency fund tailored to your lifestyle—not just a generic 3–6 month rule.

Emergency Fund Calculator – Your Personalized Number

Figuring out how much to stash in your emergency fund isn’t one-size-fits-all. Using an emergency fund calculator tailored to your situation makes a real difference. Here’s a simple step-by-step worksheet you can follow with real numbers:

Step 1: Calculate Your Base Layer

Start with 3–6 months of essential expenses — not your total spending. Focus on must-pays like rent, utilities, groceries, healthcare, and minimum debt payments. For example, if your essential monthly costs are $3,000, your base fund is $9,000 to $18,000.

Step 2: Apply Risk Multipliers

Next, adjust based on your personal circumstances:

- Single income household: Add 2–3 extra months of essentials. This adds a buffer in case your only income takes a hit.

- Self-employed, freelancer, or contractor: Jump up to 6–12 months. Income can be unpredictable, so having a bigger cushion is smart.

- High-deductible health plan or chronic illness: Add an extra $5,000–$15,000 for medical expenses that aren’t fully covered by insurance.

- Homeowner with older systems: If your house needs frequent repairs, tack on $5,000–$10,000 for home maintenance emergencies.

Putting It Together

Say you’re a self-employed freelancer with $4,000 in essential monthly expenses, a high-deductible health plan, and an older home:

- Base layer: 6 months × $4,000 = $24,000

- Freelancer multiplier: + 6 months × $4,000 = $24,000

- Health buffer: + $10,000

- Home repair buffer: + $7,500

Total emergency fund goal = $65,500

Using this personalized method helps you find a realistic, tailored financial cushion that fits your lifestyle. It’s more than just the old 3–6 month rule — it’s about what protects you.

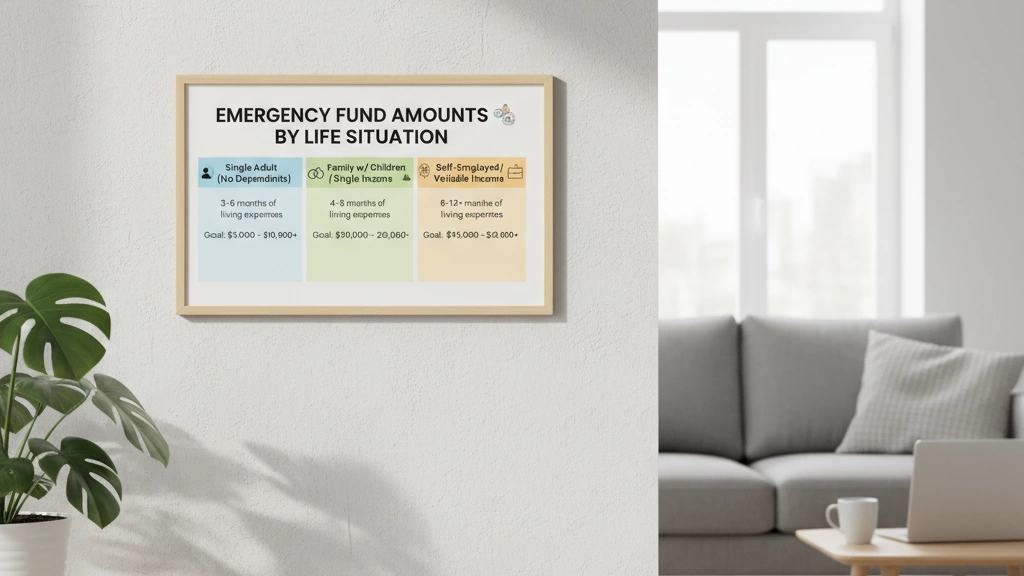

2025 Emergency Fund Benchmarks by Life Situation

Your emergency fund size depends a lot on your life setup. Here’s a quick guide for 2025 to help you picture what makes sense for your situation:

-

Single, renter, stable 9–5 job: Aim for $8,000–$18,000, which covers about 3 to 6 months of essential expenses. This fits someone with predictable income and fewer responsibilities.

-

Married, dual income, no kids: A fund between $15,000 and $30,000 works well here. With two incomes, you can lean closer to the lower end but still want a solid cushion for unexpected events.

-

Single parent or sole breadwinner: Because you’re the main financial support, plan for $25,000–$50,000, roughly 9 to 12 months of expenses. The bigger safety net reflects the added responsibilities and fewer backup options.

-

Freelancer or business owner: Income can be unpredictable, so an emergency fund of $40,000–$100,000+ is smart—think 9 to 18 months of essential costs. This helps cover gaps during dry spells or business slowdowns.

-

High-net-worth individuals with illiquid investments: Your emergency fund should be separate from assets tied up in property or long-term investments. Create a distinct “liquidity tier” with easily accessible cash or equivalents to handle short-term needs.

These benchmarks blend the classic “3 vs 6 vs 12 months emergency fund” rule with real-life factors like job type, family needs, and income stability. Use them as a starting point to tailor your personal financial cushion.

Where to Keep Your Emergency Fund (2025 Best Options)

Choosing the right place to park your emergency fund is key. You want quick access, safety, and some decent interest to beat inflation. Here’s a quick breakdown of your best options in 2025:

| Option | Pros | Cons | Best For |

|---|---|---|---|

| High-Yield Savings Account | Easy access, FDIC insured, top rates 4–5% APY | Interest can vary, withdrawal limits | Most people, safest choice |

| Money Market Funds | Slightly higher yields, check-writing features | Not FDIC insured, market risk | Those with good risk tolerance |

| Online Banks | Often higher rates than traditional banks | No physical branches | Savvy savers comfortable online |

| Credit Unions | Competitive rates, great customer service | Membership required | Local savers wanting support |

Laddering Your Emergency Fund

To balance liquidity and yield, consider laddering:

- Keep 3 months’ expenses in a high-yield savings account for instant access.

- Put the next 3–6 months in short-term CDs or tiered money market funds.

- Stagger CD terms (3, 6, 12 months) to avoid tying up all cash at once.

This way, you get decent interest without risking your ability to withdraw when needed.

What NOT to Use

Avoid risky or illiquid options for your emergency fund, including:

- Stocks or ETFs: Too volatile and can lose value when you need cash.

- Cryptocurrency: Highly unpredictable, not recommended for emergencies.

- Whole Life Insurance Cash Value: Ties money in with fees and complex rules; not liquid enough.

- Retirement Accounts: Penalties and tax hits make these a poor emergency source.

Keep your emergency fund separate from investments or sinking funds. You want it safe, liquid, and ready—no questions asked.

How to Build Your Emergency Fund Fast (Even on a Low Income)

Building your emergency fund quickly is doable, even if your income isn’t high. The key is to treat your savings like a bill you must pay every month. This is the “pay yourself first” automation method—set up automatic transfers to a high-yield savings account as soon as you get paid. It’s hands-off and keeps your emergency fund growing without you having to think about it.

Here are 6 proven side hustles that actually work in 2025 to boost your emergency fund faster:

- Freelance writing or graphic design

- Rideshare or delivery driving

- Selling handmade goods online

- Tutoring or teaching languages remotely

- Social media management for small businesses

- Virtual assistant or admin support

On the expense side, try the cut-one, save-one rule: For every unnecessary thing you cut out, put that saved cash straight into your emergency fund. For example, cancel a subscription and add that $15/month to your savings.

Timeline examples for building your emergency fund:

| Goal | How to Grow It |

|---|---|

| $1,000 (starter) | Automate $100/month for 10 months |

| $10,000 (buffer) | Add side hustle earnings + automate $300/month for 2 years |

| Full fund (3–6 months expenses) | Combine steady saving + side income streams over 3–5 years |

Remember, even small, consistent steps add up. The faster you build your emergency fund, the better your financial cushion and peace of mind will be.

Real-Life Emergency Fund Stories: What Actually Happens

Let’s look at three real-life stories that show why having the right emergency fund matters—and what happens when you don’t.

1. The Layoff

Jenny worked a steady 9-to-5 job but had only saved about two months of expenses. When her company suddenly downsized, she found herself without income faster than expected. With just two months of a fund, she struggled to cover bills and ended up dipping into credit cards, which added stress and debt. Lesson: less than 3 months is risky, especially when job stability feels uncertain.

2. The Medical Emergency

Mark is self-employed with irregular income. He saved a basic emergency fund but didn’t add a medical buffer even though he has a high-deductible health plan and a chronic condition. When unexpected surgery hit, medical bills and lost income drained his fund quickly. In his case, a larger cushion plus a dedicated health buffer ($5,000–$15,000) could have prevented financial strain.

3. The Major Car Repair

Sara owns a home with older systems and relies on her car for work. She kept a solid 6-month emergency fund covering essential expenses but forgot to set aside anything for home or car repairs. When her car needed a $5,000 fix, she had to borrow money despite the fund. Either a home repair buffer or setting sinking funds for predictable big expenses would have saved her from extra stress.

Takeaway:

People with just the “standard” emergency fund often face surprises that push them beyond their limits. On the flip side, those who customize their fund by adding buffers for health, home, and income risks sleep better at night. This shows why understanding your true emergency fund needs—and avoiding common mistakes—is crucial.

Frequently Asked Questions

Is 3 months of expenses ever enough anymore?

For some, yes—but it’s becoming rarer. Three months might work if you have a stable job, low monthly expenses, and no dependents. But with rising costs, gig work, and unpredictable layoffs, many experts now recommend 6 or more months, especially if your income isn’t steady.

Should I pause retirement contributions to build the emergency fund?

Not necessarily. If you don’t have any safety net yet, it’s smart to prioritize building at least a 3-month emergency fund first. Once that’s in place, resume retirement savings. Balancing both is ideal, but without an emergency fund, unexpected costs can force you to tap retirement money early—which has downsides.

Does unemployment insurance replace an emergency fund?

No. Unemployment benefits usually cover less than 50–60% of your income and take time to start. Plus, they’re temporary and don’t account for non-income emergencies like medical bills or major repairs. Treat unemployment insurance as a backup, not a substitute.

Can I count my Roth IRA contributions as emergency money?

You can withdraw your Roth IRA contributions (not earnings) without penalties, but it’s not recommended. Using retirement accounts for emergencies risks your future savings growth. Keep your emergency fund separate in liquid accounts like a high-yield savings account.

What if I have debt — should I save or pay off first?

Focus on building a small emergency fund (at least $1,000) before tackling high-interest debt. This prevents going deeper into debt if an emergency hits. After that, balance debt repayment and emergency fund growth based on your interest rates and stability. High-interest debts usually take priority once a basic fund is set.